- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

The Maastricht Criteria (or the Convergence Criteria) is known as part of the preparations for introduction of the Euro, the convergence criteria are formally defined as a set of macroeconomic indicators which measure:

• Price stability:

to show inflation is controlled.

to show inflation is controlled.

Consumer price inflation rate should not be more than 1.5 percentage points above the rate of the three best performing Member States

• Sound public finances:

through limits on government borrowing and national debt to avoid excessive deficit.

through limits on government borrowing and national debt to avoid excessive deficit.

Government deficit as % of GDP should not be more than 3%.

• Sustainable public finances:

through limits on government borrowing and national debt to avoid excessive deficit.

through limits on government borrowing and national debt to avoid excessive deficit.

Government debt as % of GDP should not be more than 60%.

• Exchange-rate stability:

is chosen to demonstrate that whether a Member State can manage its economy without recourse to excessive currency fluctuations.

is chosen to demonstrate that whether a Member State can manage its economy without recourse to excessive currency fluctuations.

• Long-term interest rates:

to assess the durability of the convergence achieved by fulfilling the other criteria

to assess the durability of the convergence achieved by fulfilling the other criteria

Long-term interest rate should not be more than 2 percentage points above the rate of the three best performing Member States in terms of price stability.

The Commission and the ECB assess the progress made by the euro-area candidate countries and publish their conclusions in convergence reports.

The Commission and the ECB assess the progress made by the euro-area candidate countries and publish their conclusions in convergence reports.

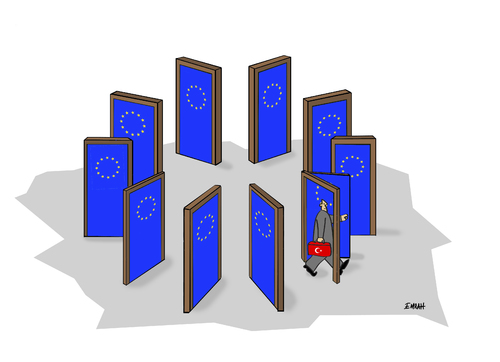

Turkey's Aim For Full European Union Membership: Are the Convergence Criteria Are Met?

Does turkey meet the maastricht criteria? Let's see.

Price stability:

Irland: 0,3

Cyprus: 0,7 → Average: 0,6

Finland: 0,8

The maximum rate shouldn't be more than 0,6 + 1,5 = 2,1,

while Turkey: 11,92 X

while Turkey: 11,92 X

Long-term interest rates:

Irland: 0,8

Cyprus: 2,62 → Average: 1,32

Finland: 0,55

The maximum rate shouldn't be more than 1,32 + 2 = 3,32,

while Turkey: 11,10 X

while Turkey: 11,10 X

Sustainable public finances:

Government debt as % of GDP should not be more than 60%

Turkey: 30,7% ✓

Sound public finances:

Government deficit as % of GDP should not be more than 3%.

Turkey: 1,5% ✓

Durability of convergence:

"...for at least two years, without devaluing against the currency of any other Member State..."

Turkey adopted the floating exchange rate under which exchange rates are determined by supply and demand. On the other hand, countries that have a fixed exchange rate use devaluation.

Turkey adopted the floating exchange rate under which exchange rates are determined by supply and demand. On the other hand, countries that have a fixed exchange rate use devaluation.

As a result

Consequently, it can be seen Turkey has met two of the four criteria. (Sustainable Public Finances & Sound Public Finances.)

On the other hand, its trouble with inflation, and therefore long-term interest rates prevent it meeting the last two criteria.

What Is Turkey's Economic Problems?

On the other hand, its trouble with inflation, and therefore long-term interest rates prevent it meeting the last two criteria.

Emel

May 2018

May 2018

References:

https://ec.europa.eu/

Is Turkey likely to join the EU?

The Convergence Criteria

The Maastricht Criteria

Turkey in the European Union

- Get link

- X

- Other Apps